41+ mortgage interest deduction income limit

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. That means that the mortgage interest you.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Web Most homeowners can deduct all of their mortgage interest.

. Ad Tired of Renting. With a Low Down Payment Option You Could Buy Your Own Home. However if you receive a tax-exempt parsonage allowance or a tax-exempt military housing.

Take Advantage And Lock In A Great Rate. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Ad Tired of Renting. Homeowners who bought houses before. Homeowners who are married but filing.

Web If you take the standard deduction you cannot also deduct your mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

For 2022 the standard deduction is 25900 for married couples and 12950. Why Rent When You Could Own. Web The mortgage interest deduction is a tax deduction you can take for mortgage interest paid on the first 1 million of mortgage debt during that tax year.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web For federal purposes the itemized deduction rules for home mortgage and home equity interest you paid in 2021 have changed from what was allowed as a.

With a Low Down Payment Option You Could Buy Your Own Home. Why Rent When You Could Own. Use NerdWallet Reviews To Research Lenders.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

With a Low Down Payment Option You Could Buy Your Own Home. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web Here is a list of the most common tax write offs you can claim via IRS tax credits and IRS tax deductions. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Web Generally you cannot deduct expenses that are allocable to tax-exempt income. This non-refundable tax credit is. 750000 if the loan was finalized.

It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. With a Low Down Payment Option You Could Buy Your Own Home. Web The total average balances during 2006 and 2007 of the Beverly Hills mortgage and home-equity loan and the Rancho Mirage mortgage were 2703568.

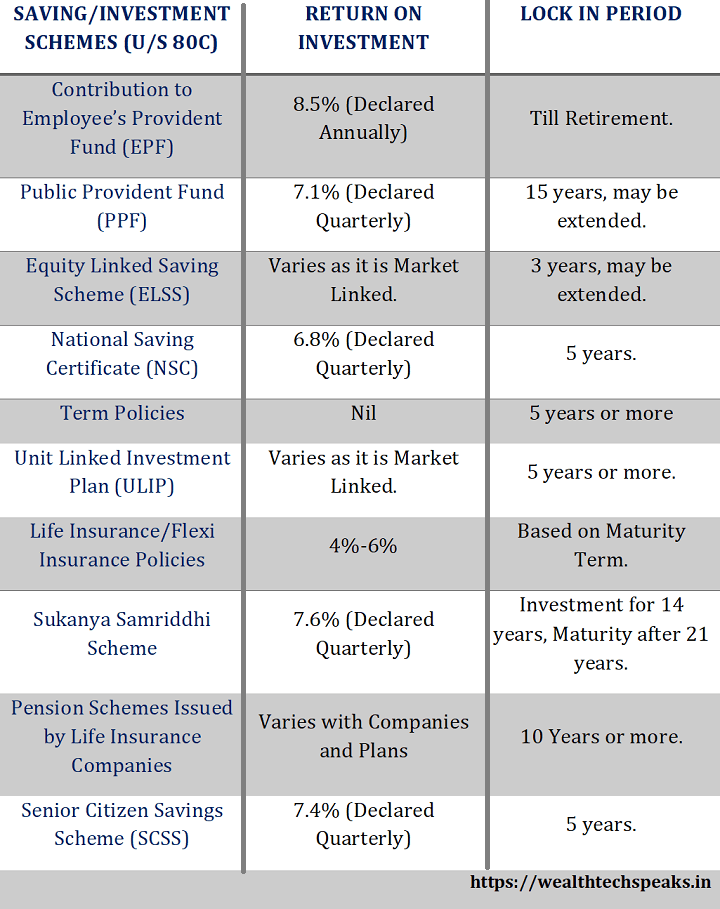

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Mortgage Interest Deduction Limit And Income Phaseout

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Treatment Of Standard Deduction Rs 50000 Under The New Tax Regime

Pdf Lone Parent Families In The Uk

Mortgage Interest Deduction Bankrate

Intouchjan Feb2016 By Into Issuu

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Brian Aldiss Trillion Year Spree Pdf Pdf Science Fiction Analog Science Fiction And Fact

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Will The Standard Deduction Of Rs 40 000 On Income Tax Help The Salaried In India Quora

Mortgage Interest Deduction Rules Limits For 2023

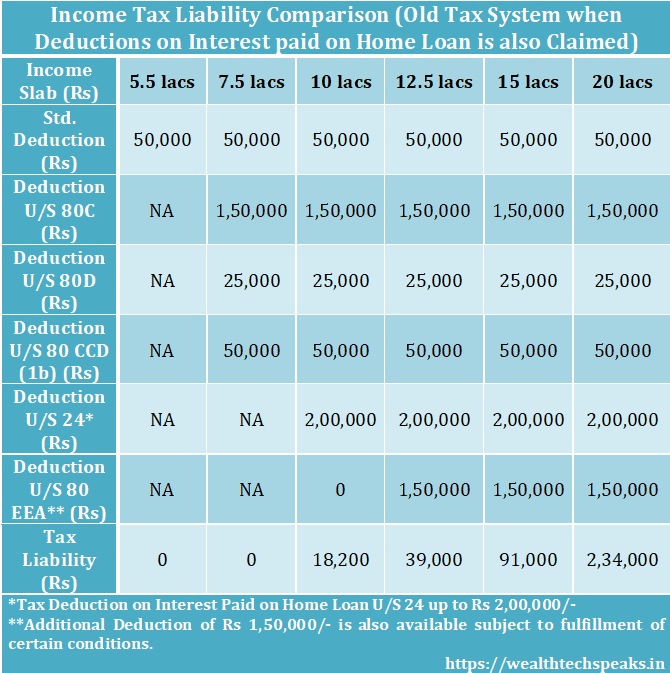

Income Tax Comparison New Vs Old Fy 2020 21 Wealthtech Speaks